- 609-345-2203

- info@bloomrealtyinsurance.com

- 3542 Atlantic Ave, Atlantic City, NJ 08401

Personal Insurance

Home is the place we retreat to, to be safe when the world is not. Now, more than ever, home is our sanctuary. But it’s also our office, school, daycare and gym. These times are uncertain, but some things never change. Trusted Choice Independent Insurance Agents like us can help you make sense of confusing circumstances. If you need us, we’re here. No matter what tomorrow brings.

What Is Homeowners Insurance?

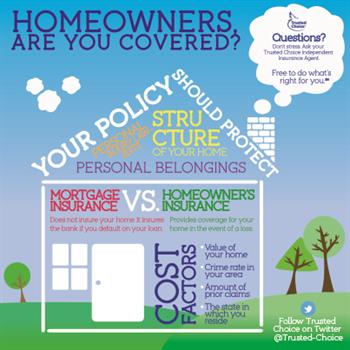

Homeowners insurance is a form of property insurance that covers losses and damages to an individual’s residence, along with furnishings and other assets in the home. Homeowners insurance also provides liability coverage against accidents in the home or on the property.

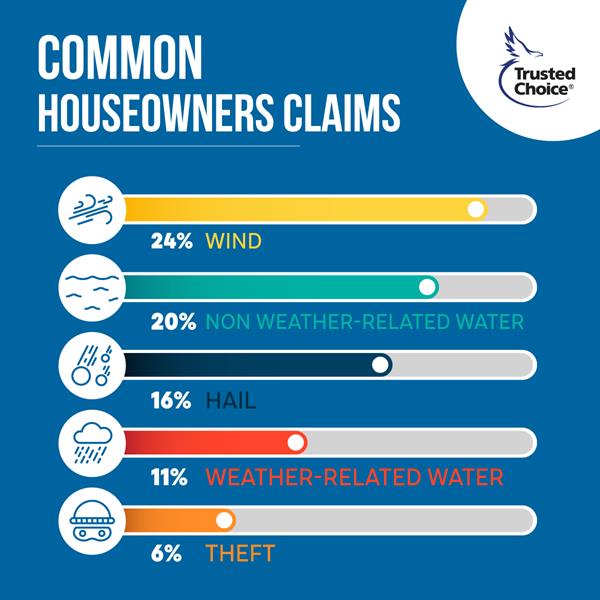

A homeowners insurance policy usually covers four kinds of incidents on the insured property—interior damage, exterior damage, loss or damage of personal assets/belongings, and injury that occurs while on the property—. When a claim is made on any of these incidents, the homeowner will be required to pay a deductible, which in effect is the out-of-pocket cost for the insured.

When applying for a mortgage, the homeowner usually is required to provide proof of insurance on the property before the financial institution will loan any funds. The property insurance can be acquired separately or by the lending bank. Homeowners who prefer to get their own insurance policy can compare multiple offers and pick the plan that works best for their needs. If the homeowner does not have their property covered from loss or damages, the bank may obtain one for them at an extra cost. Payments made toward a homeowners insurance policy are usually included in the monthly payments of the homeowner’s mortgage. The lending bank that receives the payment allocates the portion for insurance coverage to an escrow account. Once the insurance bill comes due, the amount owed is settled from this escrow account.

Do you need homeowner’s insurance if you don’t have a mortgage?

Forbes says it’s a good idea to consider having a homeowners insurance whether you could afford to repair or rebuild your house if it were damaged or destroyed.

Homeowners insurance typically helps cover the costs of repairs if your home is damaged due to a covered peril, such as fire, hail, lightning or vandalism, says the III. And, should you not be able to stay in your house while it is repaired or rebuilt, your policy may also help cover additional living expenses if you have to temporarily stay in a hotel.

HOME INSURANCE COVERS:

- Your dwelling

- Other structures on your property

- Personal property

- Liability for injuries or damage to someone else’s property

As Independent Insurance Agents our goal is to find YOU the best fit for your needs!

Flood insurance

Ninety percent of all natural disasters in the United States involve flooding, and flood damage strikes frequently in low or moderate risk areas. Homeowners policies don’t cover flooding so—whatever your area’s risk level—learn about flood insurance protections from our Independent Insurance Agents.

According to the Federal Emergency Management Agency (FEMA) floods—including inland flooding, flash floods and flooding from seasonal storms—occur in every region of the United States. In fact, 90 percent of all natural disasters in the U.S. involve some type of flooding.

If you’re moving into a new home, apartment or business location, ask your mortgage lender, your local officials or your insurance professional if the location has been known to flood. The National Flood Insurance Program (NFIP) will also be able to provide flood risk information on your area, especially it is a must have on our Island.

Floods are not covered under homeowners and renters policies. Only a specific flood insurance policy will cover home flood related losses. Having a flood insurance policy is way to protect your assets most fully from the cost of flood damages and loss. Without insurance, relief from floods primarily comes in the form of loans. If your community is declared a disaster area, no-interest or low-interest loans are often made available by the federal government as part of the recovery effort. However, these loans must be paid back, which means you’re still liable for the entire cost of your damages or losses.

Condo insurance

Condos offer the benefits of home ownership without all the risk. Shopping for condo insurance, also called HO6 insurance, is often easier and cheaper than typical homeowners insurance and may even be subsidized by your homeowners association. Condo insurance works similarly to single-family homeowners insurance, but it’s usually a little more customizable. You may decide that you only want to buy personal property and liability insurance if your dwelling insurance is covered by your homeowners association. Condo insurance is especially important because damage to your unit doesn’t affect just you. It affects your neighbors in your building or complex, too.

If you’re considering buying a condo, or you already own one, our independent insurance agents are on hand to help you shop for the insurance coverage that’s just right for YOU.

Condo insurance—which is also called HO6 insurance— has three parts:

Dwelling Insurance: Covers structural elements like walls and floors.

Personal Property Insurance: Covers your possessions stored in the unit

Liability Insurance: Covers legal fees if someone sues you in cases related to your home.

Umbrella Policy

Umbrella insurance is a separate insurance policy that acts as a liability “umbrella” in the sense that it extends over almost all of your underlying insurance policies, such as your auto, home, motorcycle, and boat policies.

It’s a liability-only policy, meaning there is no physical damage coverage for anything. It simply gives you extra liability limits that you can use if you exhaust your auto or home liability limits in a claim.

Umbrella insurance covers lawsuits, settlements, and legal defense costs that you’re involved in, as long as the reason for the lawsuit is covered in the policy. The lawsuit must be a civil lawsuit, known as a tort, and not a criminal one.

If you’re unsure of what your options are, you can speak with our independent insurance agents who can guide you through the process and provide you with multiple quotes on all of your insurance policies, including umbrellas.

Contact us

Location

3542 Atlantic Ave, Atlantic City, NJ 08401